How to Analyze Stock Market Trends for Beginners

In this post, we will learn about How to Analyze Stock Market Trends, and we will go through the most common way of examining securities exchange patterns, explicitly custom-fitted for novices. Understanding business sector patterns is vital expertise for any financial backer, as it gives significant bits of knowledge into the course of a specific stock’s cost. Here is a complete guide on How to Analyze Stock Market Trends.

By excelling at pattern examination, you can go with informed venture choices and work on your odds of coming out on top in the financial exchange.

Introduction to How to Analyze Stock Market Trends

Securities exchange pattern examination includes analyzing authentic value information to recognize examples and potential future cost developments. This investigation assists financial backers with deciding the general heading of a stock’s value, whether it’s climbing (bullish), down (negative), or sideways (nonpartisan). As a fledgling, it’s crucial to start with the nuts and bolts Step by step. construct your skill in this field.

Using Moving Averages-How to Analyze Stock Market Trends

One of the most generally perceived and convincing procedures for researching monetary trade designs is using moving midpoints. A moving typical is a resolved ordinary of a stock’s expense over a specific period. It smooths out transient instabilities, making it more direct to perceive the essential example.

Read this post – Stock Market Strategies for Optimal Returns

To utilize moving midpoints, follow these means:

Pick a Time span: Select a time span that lines up with your venture objectives. Momentary brokers might utilize a 20-day moving normal, while long-haul financial backers could favor a 200-day moving normal.

Plot the Moving Normal: On a stock diagram, plot the moving normal in view of the time period you chose.

Investigate Hybrids: Watch for hybrids between the stock’s cost and the moving normal. At the point when the cost crosses over the moving normal, it demonstrates a potential upswing. On the other hand, when the cost crosses underneath the moving normal, it proposes a potential downtrend.

Analyzing Price Patterns-How to Analyze Stock Market Trends

In addition to moving averages, analyzing price patterns can provide valuable insights into stock market trends. Price patterns are repetitive formations on a stock chart that indicate potential future price movements.

Some common price patterns include: How to Analyze Stock Market Trends

- Head and Shoulders: This pattern resembles a head with two shoulders and indicates a possible trend reversal from bullish to bearish or vice versa.

- Cup and Handle: A bullish continuation pattern that indicates a brief pause in the uptrend before it continues.

- Double Top/Bottom: These patterns show a potential trend reversal after reaching the same high or low price twice.

Understanding Support and Resistance

Support and resistance levels are crucial concepts in trend analysis. Support is a price level at which a stock tends to stop falling, while resistance is a price level at which a stock tends to stop rising. Identifying these levels can help you make more informed decisions about entry and exit points for your trades.

Read more here – The 5 Best Stocks For Long-Term Investment

Utilizing Technical Indicators

Technical indicators are mathematical calculations based on a stock’s price and/or volume. They provide additional insights into market trends and can help confirm or refute your analysis.

Some popular technical indicators include:

- Relative Strength Index (RSI): This indicator measures the speed and change of price movements and helps identify overbought or oversold conditions.

- Moving Average Convergence Divergence (MACD): MACD illustrates the relationship between two moving averages and provides signals for potential trend changes.

- Bollinger Bands: Bollinger Bands consist of three lines that indicate price volatility and potential reversal points.

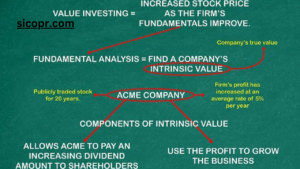

The Importance of Fundamental Analysis

While the specialized investigation is fundamental for pattern examination, it’s similarly urgent to consider essential factors that can impact a stock’s cost. Factors, for example, organization financials, industry patterns, and monetary circumstances can influence a stock’s presentation in the long haul.

Mermaid Diagram – Trend Analysis Process

graph TD

A(Choose Timeframe)

B(Plot Moving Average)

C(Analyze Crossovers)

D{Uptrend?}

E{Downtrend?}

F{Sideways?}

A --> B --> C --> D

C --> E

C --> F

Conclusion-How to Analyze Stock Market Trends

Analyzing stock market trends is a skill that every beginner investor should strive to master. By using moving averages, understanding price patterns, identifying support and resistance levels, and utilizing technical indicators, you can gain valuable insights into market movements.

Must read this post – Warren Buffett’s Secrets: Lessons from the Oracle of Omaha for Stock Market Success

Additionally, don’t forget the importance of fundamental analysis, as it provides a more comprehensive view of a stock’s potential. Continuous learning and practice will sharpen your trend analysis abilities, empowering you to make well-informed investment decisions and potentially outperform competitors in the stock market. Happy investing!

Frequently Asked Questions (FAQ) – How to Analyze Stock Market Trends for Beginners

1. What is stock market trend analysis?

Stock market trend analysis involves studying historical price data and patterns to identify the overall direction of a stock’s price. It helps investors make informed decisions about potential investment opportunities.

2. Why is stock market trend analysis important for beginners?

For beginners, understanding the market trends is crucial as it provides valuable insights into whether a stock is likely to move up, down, or remain neutral. This knowledge can help beginners make more confident investment choices.

3. How do I use moving averages for trend analysis?

To utilize moving midpoints, select a time period (e.g., 20-day or 200-day) and plot the moving typically on a stock diagram. Dissect hybrids between the stock’s cost and the moving normal to recognize potential upswings or downtrends.

4. What are some common price patterns in stock market trend analysis?

Some common price patterns include the head and shoulders, cup and handle, and double top/bottom. These patterns indicate potential trend reversals or continuations.

5. What do support and resistance levels mean in trend analysis?

Support is a cost level at which a stock will in general quit falling, while opposition is a cost level at which a stock will in general quit rising. Distinguishing these levels can assist financial backers with settling on better passage and leave choices.

6. What are technical indicators, and how do they help in trend analysis?

Technical indicators are mathematical calculations based on a stock’s price and volume. They provide additional insights into market trends and can help confirm or refute your analysis. Some popular ones include RSI, MACD, and Bollinger Bands.

7. Is fundamental analysis essential for trend analysis?

Yes, while technical analysis is crucial, considering fundamental factors such as company financials, industry trends, and economic conditions is equally important. Both analyses together provide a comprehensive view of a stock’s potential.

8. How can beginners improve their trend analysis skills?

Beginners can enhance their trend analysis skills through continuous learning, practice, and staying updated on market news and trends. Using virtual trading platforms can also help gain practical experience.

9. Can trend analysis guarantee profitable investments?

No, pattern examination is a device that improves the probability of settling on informed choices, however, it doesn’t ensure benefits. Different elements, like gambling the executives and enhancement, assume a critical part in effective money management.

10. Should beginners solely rely on trend analysis for investing?

No, beginners should use trend analysis as part of a comprehensive investment strategy. Combining it with fundamental analysis, risk assessment, and proper research will lead to better investment outcomes.

11. What are some reliable sources for stock market data and analysis?

There are several reputable financial websites and platforms that provide stock market data and analysis. Some popular sources include Yahoo Finance, Bloomberg, and CNBC.

12. How frequently should I analyze stock market trends?

The frequency of analysis depends on your investment style and goals. Short-term traders may analyze trends daily, while long-term investors might do it weekly or monthly.

13. Can trend analysis be applied to other financial markets, like forex or cryptocurrencies?

Yes, trend analysis principles can be applied to various financial markets, including forex and cryptocurrencies. However, each market may have unique characteristics that require specialized knowledge.

14. What are the risks associated with trend analysis in the stock market?

While pattern examination is a significant device, it’s not secure. There is consistently a gamble of bogus signs or unforeseen market occasions that can prompt misfortunes. A legitimate gamble for the executives is fundamental.

15. Are there any software tools that can assist with stock market trend analysis?

Yes, there are numerous software tools and platforms that offer technical analysis features and charting tools to aid in trend analysis. Some popular options include TradingView, ThinkorSwim, and MetaTrader.

Remember, trend analysis is just one aspect of successful investing. Enhancement, risk the board, and nonstop learning are key components to making long-haul venture progress. Continuously talk with a monetary guide prior to settling on critical speculation choices.

Thanks for reading this post